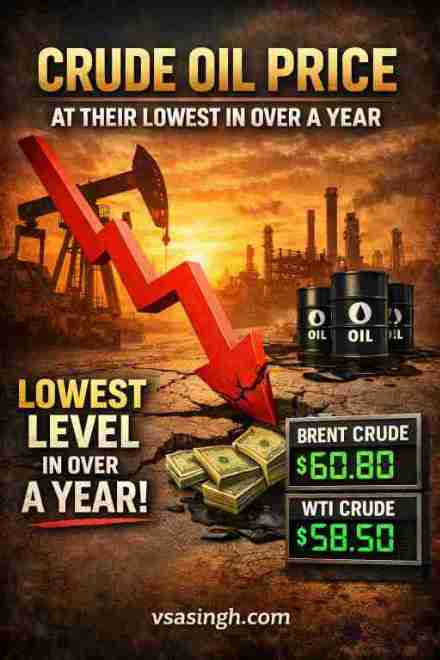

As of January 5, 2026, crude oil price are trading near their lowest levels in over a year, continuing a downward trend that began in late 2025. Both major benchmarks saw slight declines today as markets react to high supply levels and cautious economic outlooks.

Current crude oil prices (as of today, January 5, 2026):

- WTI Crude Oil: $57.32–57.35 per barrel

- Brent Crude Oil: $60.75–60.84 per barrel

- Dubai Crude Oil: $60.20 per barrel

- Urals Crude Oil: $50.44 per barrel

Key Benchmarks Explained

- WTI (West Texas Intermediate):

- North American benchmark, traded on NYMEX.

- Known as “light, sweet crude” due to low sulfur content.

- Price today: ~$57.3 per barrel.

- Brent Crude:

- Global benchmark, representing oil from the North Sea.

- Used in ~60% of international oil trade.

- Price today: ~$60.8 per barrel.

- Dubai Crude:

- Middle East benchmark, important for Asia-Pacific pricing.

- Price today: ~$60.2 per barrel.

- Urals Crude:

- Russian export blend, medium sour crude.

- Price today: ~$50.4 per barrel.

📊 Comparison Table

| Benchmark | Region/Use Case | Current Price (USD/barrel) | Characteristics |

|---|---|---|---|

| WTI Crude | North America | ~57.3 | Light, sweet crude |

| Brent Crude | Global (Europe focus) | ~60.8 | Global benchmark |

| Dubai Crude | Middle East/Asia | ~60.2 | Sour crude, Asia pricing |

| Urals Crude | Russia export blend | ~50.4 | Medium sour crude |

Market Context & Trends

- Annual Performance: Oil prices have dropped significantly over the last 12 months, with WTI down approximately 22% compared to early 2025.

- OPEC+ Influence: Markets are currently focused on recent OPEC+ meetings.1 Traders are watching for any shifts in production quotas intended to stabilize prices amidst a perceived global surplus.

- Supply vs. Demand: High storage levels in the U.S. and a “softer” post-holiday demand period are currently acting as a ceiling on price growth, offsetting some of the risks posed by ongoing geopolitical tensions.

Key Factors Impacting Prices Today

- High Inventory: Strong production from non-OPEC countries (particularly the U.S.) has kept global inventories robust.

- Economic Outlook: Milder-than-expected winter weather in early 2026 has reduced the demand for heating oil, a major driver of crude consumption.

- Geopolitical Risk: While sanctions and regional conflicts remain a concern, the “risk premium” has faded as supply routes have proven resilient.

Price Forecast

The U.S. Energy Information Administration (EIA) currently expects Brent crude to average roughly $55 per barrel throughout 2026, suggesting that prices may remain under pressure for the foreseeable future.

Things to Keep in Mind

- Volatility: Oil prices fluctuate daily due to supply-demand dynamics, geopolitical tensions, and OPEC+ decisions.

- Currency impact: Prices are quoted in USD; local currency conversion (like INR) can change the effective cost.

- Market drivers right now: OPEC+ has reaffirmed output pauses, citing market stability despite political

Would you like me to also show you the crude oil price in Indian Rupees (INR) for easier local context?

Related

- Brent crude price right now

- WTI crude price right now

- Crude oil price change today percentage

- Crude oil day high and low values

- Crude oil futures contract nearest expiry price

Leave a Reply